Bussiness

Billionaire investor Ray Dalio warns of threat to democracy

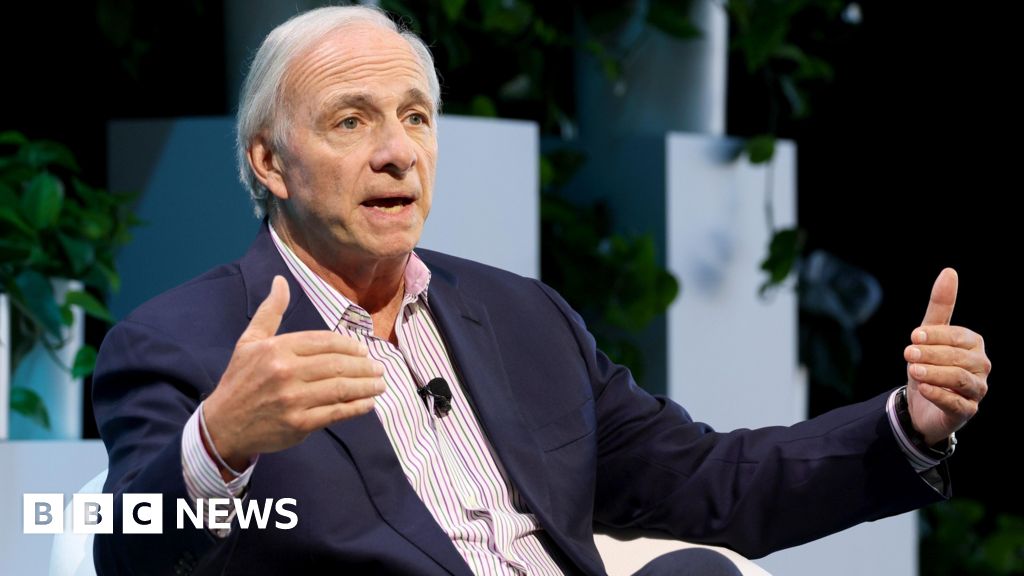

A billionaire investor who predicted the global financial crisis has warned that the US election risks tipping the world’s biggest economy into serious disorder.

In a week when candidates Kamala Harris and Donald Trump finally faced each other in a televised debate, Ray Dalio said his biggest fear was for democracy no matter who wins on 4 November.

Mr Dalio founded the world’s largest hedge fund and is closely-watched by other investors for his stock-picks.

In an interview with the BBC, he said: “There’s a possibility that the loser, particularly if it’s the Republicans and Donald Trump, might not accept losing and you have a situation where it’s a win-at-all-cost by both the left and the right, so neither side can compromise.

“My great fear is for democracy,” he said.

Regardless of the victor, Mr Dalio said he expected there to be internal migration between states based on political, economic and moral dividing lines.

“A lot of people in states like California and New York and New Jersey and so on, will go to states like Florida and Texas, partially because of taxes, but partially because of values,” he said. “There’s a big gap in values”.

“This reminds me of the 1930 to 45 period in which there was an economic crisis followed by democracies becoming dictatorships. Germany, Italy, Spain and Japan had parliamentary systems, and they broke down in terms of internal conflict between the the hard left, the hard right, communism and fascism. We are today seeing modern day versions of some of these things”, he said.

There is some evidence that US migration based on values is already happening. Elon Musk announced in July he would move the headquarters of his companies X and SpaceX from California to Texas citing new rules banning schools from notifying parents that children wanted their gender redefined.

Dalio, now 75, is the founder of Bridgewater Associates – the world’s largest hedge fund with $124bn in assets . He says he thought the probability of civil war was “low, but cannot be dismissed.”

Dalio, mercifully, does not claim he is infallible. But he insists he is more often right than wrong.

“He who lives by the crystal ball is destined to eat ground glass. But I’ve been right in the markets about 65% of the time”, he said.

But on the most immediate question in the US he is hedging his bets and refuses to be drawn on whether he thinks Trump or Harris will win.

“I do not know how this election is going to turn out and how these things will turn out. I do know that we have an exceptionally high probability of instability”, he concluded.