Bussiness

ASX closes higher, Aussie dollar recovers, Chinese factory output lower than expected — as it happened

Markets snapshot

- ASX 200: +0.5% to 8,201 points

- Australian dollar: +0.4% to 62.12 US cents

- Wall Street: Dow -0.1% S&P 500 -0.4% Nasdaq -0.9%

- Europe: Dax -0.4% FTSE +0.6%

- Spot gold: +0.4% $US2,633.54/ounce

- Iron ore: Flat at $100.97 a tonne

- Brent crude: +0.3% to $US74.86/barrel

- Bitcoin: +0.6% to $US95,311

Price current around 4.10pm AEDT

Live updates on the major ASX indices:

See you tomorrow!

Thanks for tuning into everyone, it was a busy start to 2025 for the market.

Tune in tomorrow for more financial news and (potential) market turmoil.

Loading

ASX closes higher

The ASX has closed higher on its first day of trading for 2025.

At the close, the ASX 200 was up +0.5% to 8,201 points.

Just three of the 11 sectors ended in the red: Consumer Non-Cyclicals, Education and Industrials.

Energy closed up +1.2%, Real Estate +1.1% and Basic Materials +1%.

Lithium miner Liontown ended the day at the day with solid gains up +7.6%, followed by Paladin Energy (+4.5%).

You’ve probably got the ‘right to disconnect’ now. If you don’t, you will soon

Hi team,

Just jumping in to answer a few questions I’ve been receiving about the ‘right to disconnect’, a new law that gives employees the ability to reasonably refuse contact outside of work hours, and protects them in doing so.

There’s an article at the bottom that lays out more detail.

– But my boss still calls me!

The law, which came into effect in August, doesn’t prohibit employers from contacting employees outside of their paid hours. What it does is give them the right to refuse such contact if it is reasonable to do so.

– Ah, what’s ‘reasonable’?

A few lawyers reading along, I see. OK, this is the issue. The legislation was deliberately thin, setting out two key elements for solving disputes: deal with them at a workplace (boss/worker) level first, escalate to the industrial umpire (Fair Work Commission) if that fails.

Most were expecting the Commission to rapidly hear what are called ‘test cases’ that would result in precedents and thus guidelines of what is reasonable. But as far as the ABC and experts in the field are aware, that hasn’t happened! So people are either sorting things out internally, or not dealing with the issue (and creating the conditions for someone to raise a dispute).

– When am I covered?

The law covers people working for companies with over 15 employees. Almost 2.5 million small businesses, and their employees, will be covered from late August 2025.

– What do I do with all my newly-discovered free time?

Up to you really.

A question on China’s output

Hi Rachel. Happy 2025

With Donald Trump promising big tariff increases for Chinese goods when he takes over , isn’t it a bit surprising that Chinese factories aren’t working flat out to get stocks into the USA beforehand , not cutting back as the Caixin report says?– Phillip

G’day Phillip and Happy New Year to you too!

That’s a very good point and the reason why output is lower than expected is due to a drop in orders.

Trump has threatened to impose tariffs of up to 60% on goods coming from China and his inauguration is right around the corner so orders have dropped because if you order now you may not see those goods before tariffs are imposed.

Already some Chinese companies are trying to get ahead of the game and have moved production to Mexico (that of course could end up being a problem if Trump moves ahead with his propsoed 25% tariff on Meixcan imports).

There’s also so much uncertainty right now. Will these tariffs actually be imposed? If so, how high will they be? Will Canada and Mexico be affected? If they are, what then? And the market hates uncertainty, hence fewer orders being placed, lower output.

The market is also a fickle fellow of course, and this could all change on a dime so as always, stay tuned.

It’s 2025 … so let’s plan a holiday

We all love a public holiday (well, except for journalists who have to work them) and our reporter Elissa has created a handy guide for how to maximise your leave for the most days off in a row.

Have a read:

Have you had issues with your EFTPOS card since NYD?

An industry-wide EFTPOS update that took effect yesterday might be impacting some debit card payments made using mobile wallets such as Apple Pay and Google Pay.

Australian Banking Association chief executive Anna Bligh says the issue should “only impact a small number of customers”, but if you’ve had any issues, let us know!

More here:

US tariffs on China strain factory outputs

Output from China’s factories grew in December but at a slower-than-expected pace.

Overall sales dropped due to falling export orders amid fears of a trade war with the US, Reuters reports.

An official survey shows manufacturing activity expanded modestly, reinforcing calls for more stimulus from the Chinese Communist Party to push growth.

The Caixin/S&P Global manufacturing PMI — a monthly survey providing insights into the health of China’s manufacturing sector — nudged down to 50.5 in December from 51.5 the previous month (a score below 50 means the industry is contracting).

The score signalled a three-year low for output expansion as growth in new orders slowed.

New export orders, in particular, returned to contractionary terrain, marking the fourth month of decline in the past five months.

“The external environment is expected to be more complex this year, requiring early policy preparation and instant response,” said Wang Zhe, economist at Caixin Insight Group.

Policymakers have vowed to raise pensions and expand a consumer goods trade-in scheme in 2025, adding they will work to increase household incomes and “vigorously boost consumption”.

Alleged Chinese hackers targeted US depts in charge of sanctions

Earlier this week we brought you the news that China was allegedly behind the hack of the US Treasury office.

The Washington Post has an update.

The Post cited unnamed government officials, who claimed the hackers compromised departments in charge of economic sanctions including the Office of Foreign Assets Control and the Office of Financial Research, and the office of US Treasury Secretary Janet Yellen.

Earlier this week, the department disclosed in a letter to lawmakers that hackers stole unclassified documents in a “major incident.” It did not specify which users or departments were affected.

Asked about the paper’s report, a spokesperson for the Chinese Embassy in Washington, Liu Pengyu, said the “irrational” US claim was “without any factual basis” and represented “smear attacks” against Beijing.

The statement said China “combats all forms of cyberattacks” and did not directly address the Washington Post’s reporting on specific targets.

The Treasury letter earlier this week said hackers compromised third-party cybersecurity service provider BeyondTrust.

New Chinese home prices rise a tad faster in December

The price of new homes in China rose ever-so-slightly faster in December.

Reuters is reporting the average price of new homes across 100 cities rose 0.37% from a month earlier, compared with the 0.36% rise in November, according to data from property researcher China Index Academy.

On a year-on-year basis, the average price rose 2.68% in December, versus 2.40% growth in the previous month.

Official data for home prices will be released by China’s statistics bureau later this month.

ASX up at midday trading

The Aussie dollar has clawed its way back at midday trading, up ever so slightly above 62 US cents.

Mining companies are leading the top movers with Fortescue, Alcoa and Deep Yellow all up between +2% and +3%.

WiseTech has also made gains, up +2.2% to $123.80.

But healthcare has taken a slide this afternoon. The sector is down 0.1% with Clarity (-4.1%), Telix (-3.5%), and Neuren (-2.2%) pharmaceuticals all leading the bottom movers.

Trump’s inauguration is just shy of 3 weeks away

How do you predict the US markets will react to the trump inauguration?

– Ben

Happy New Year Ben!

Interesting question and the short answer is it’s likely to react positively because the market loves certainty and there’s usually a honeymoon phase after a US election.

I had a look back at what happened in 2016/17 when Trump was first elected.

Back then, the US stock market reacted positively in what was dubbed the ‘Trump Bump’.

The S&P 500 rose 6.6% between Trump’s first election and his inauguration.

Trump’s pro-business agenda, including promises of tax cuts, deregulation, and infrastructure spending, all helped boost the market.

There was also a strong economy at the time.

However, after Joe Biden was elected in 2020, the S&P 500 rose 14%.

But when it comes to the stock market, past performance does not predict future performance … and Trump’s threats of tariffs on Chinese, Mexican and Canadian goods has already proved volatile.

Anything that firms up those threats after inauguration will definitely have an impact on global prices.

How the Aussie dollar affects the RBA’s rate cut decision

When the Aussie dollar is weak it usually leads to higher prices because goods and services overseas become more expensive.

Following that line of thinking … it could lead to higher inflation in Australia … which in turn would make the RBA wary of a rate cut.

But AMP economist Shane Oliver says the economic climate of the past few years means that likely won’t happen.

Households, he said, have been struggling for years now to make ends meet, which disincentivises businesses from putting prices up.

Businesses are more likely to absorb higher costs in the hopes it will be short-lived rather than risk turning off customers with higher prices.

And that would stave off a rise inflation, keeping the Reserve Bank board happy.

“I don’t think this changes the RBA’s rate cut forecast at this stage. If the dollar falls below 60c it may, but even then the RBA will look at the circumstances under which that is occurring,” Oliver says.

What does a weak dollar mean for rates?

Happy new year ABC business team! Keep up the great work in 2025. What’s the latest with the Aussie dollar? Cheers ☕️

– Frank

Thanks Frank!

I’ve just spoken with AMP economic analyst Shane Oliver who had some great insights into the fall of the Aussie dollar and what it could mean for rates.

My colleague Dave Chau just spelt out how China and the US are affecting the dollar.

But there’s a big wide world out there and China and the US aren’t the entire picture.

Shane Oliver says that while the Aussie dollar fell about 9% on greenback in 2024, it only fell about 5% against all global currencies.

“The trade weighted index has been around 5% for 4+ years,” he said.

“We’re at the low end of that but in the same range. We have been here before.

“It’s a prefect storm of factors; softer commodity prices in part due to iron ore, concerns about China and fears of a trade war.

“Lately the concern that the US Federal Reserve won’t cut rates makes it less attractive to park money in Australia.

“It’s not great if you’re going on holiday to the US, but I don’t think it’s enough to change the RBA’s thinking at this stage.”

Meaning a rate cut remains on the cards for early this year.

China’s property meltdown is also weighing on the Australian dollar

Now here is ‘part two’ of why the Australian dollar is so weak.

In addition to the strong US dollar (partly driven by Donald Trump’s inflationary policies), China’s sluggish economic recovery is another contributing factor.

Our largest trading partner is experiencing is facing a deflation problem (ie. prices are falling because consumers confidence is so low, and their spending has fallen significantly).

Not only that, property prices in China have been falling for several years (with new home values down 5.7% in the year to October).

This was mainly due to the Chinese government cracking down on rampant borrowing (and a debt addiction) in the nation’s housing sector — which led to the near-collapse of Evergrande, Country Garden and other major property developers.

China’s government has been under immense pressure to introduce even more stimulus to prop up its economy and property sector (with more expected to be unveiled if Trump escalates the US-China trade war by imposing more tariffs, which is likely to happen).

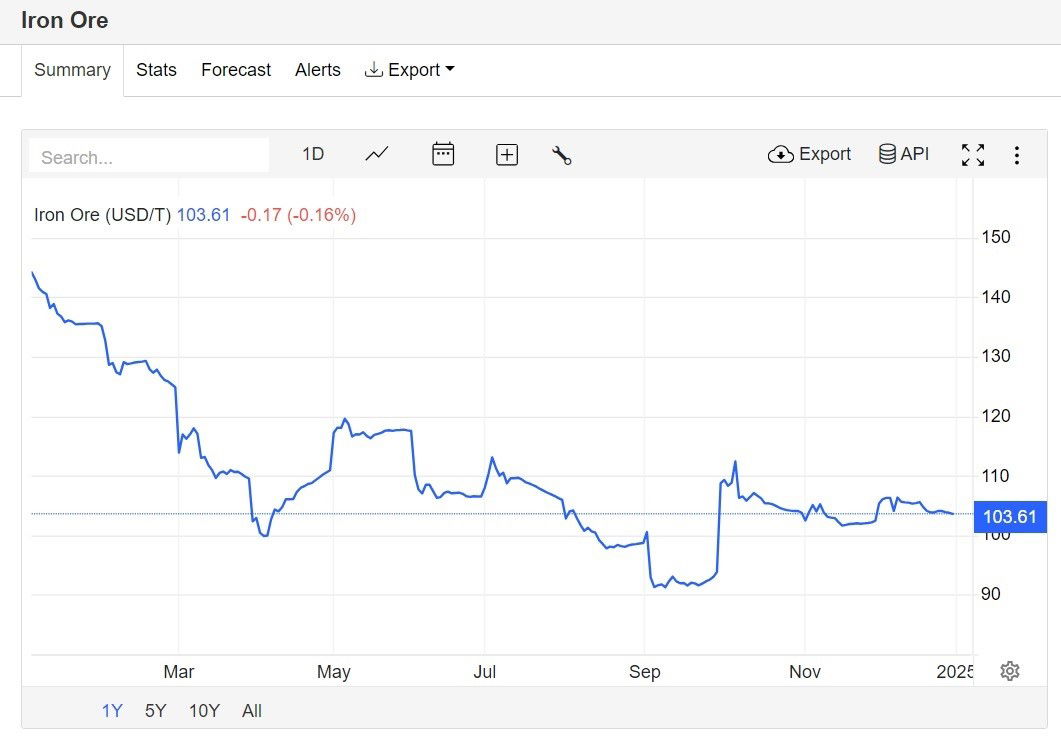

The flow-on effect is the price of iron ore falling sharply to about $US103 per tonne (down from its peak of $US143 at the beginning of last year).

Iron ore is Australia’s major export to China (and a key ingredient for making steel).

So with China’s property sector facing a long-running crisis, it’s unlikely it will need to buy as much iron ore from Australia’s miners.

Weaker demand for iron ore is also contributing to the falling AUD (which is good for Australian businesses exporting goods to foreign countries, but bad for those who are holidaying overseas).

So there you have it! That’s your crash course on what’s happening with the Aussie dollar.

Hopefully this knowledge comes in handy at your next trivia night, or if you want to impress your friends at your next drinks event!

Donald Trump’s policies are dragging the Aussie dollar lower

The Australian dollar dropped as low as 61.84 US cents this morning, its weakest level since April 2020 (the early days of the COVID-19 pandemic).

So what’s going on, you may be wondering?

The short answer is that the world’s most important currency (the US greenback) has been incredibly strong lately!

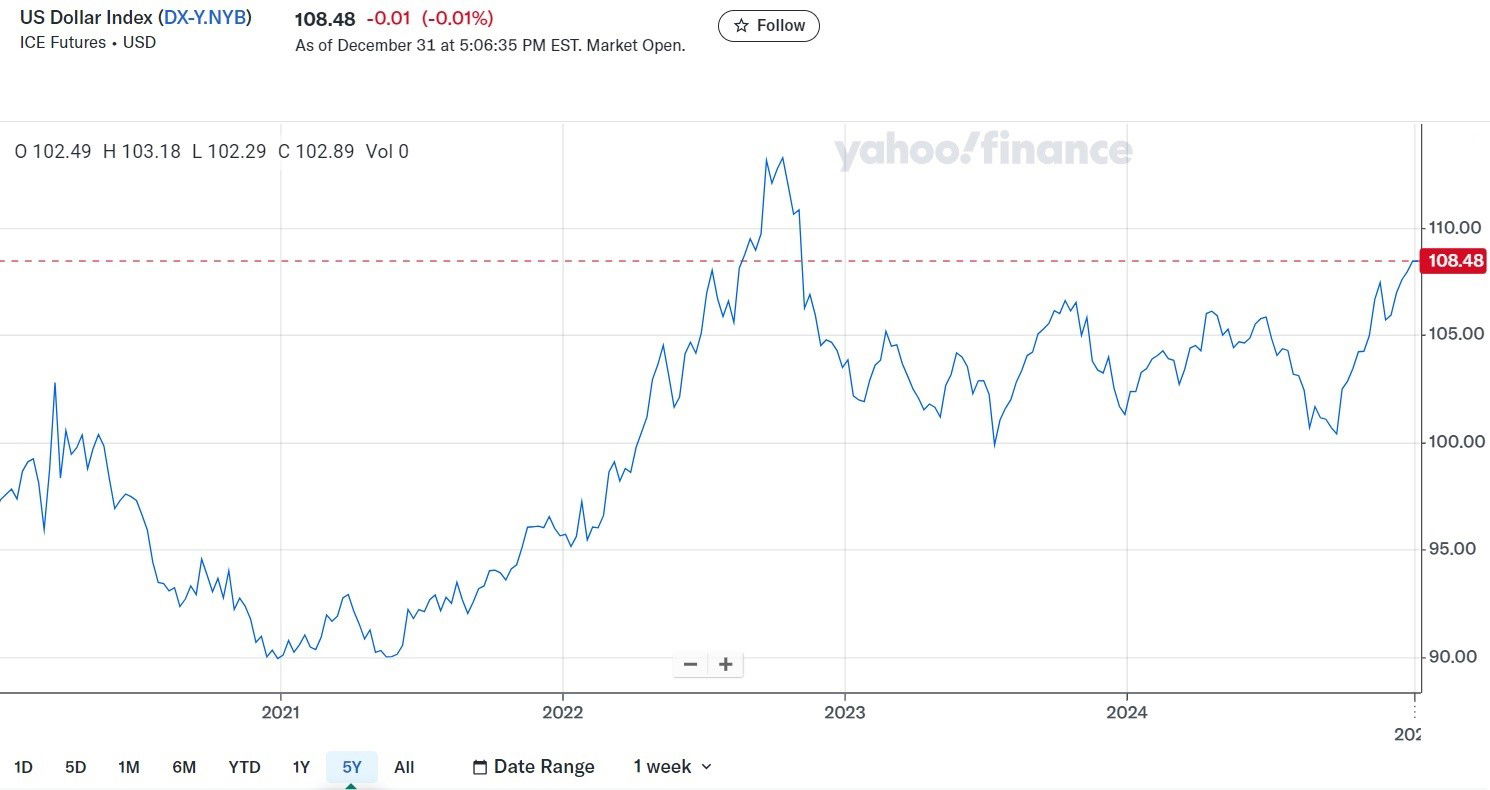

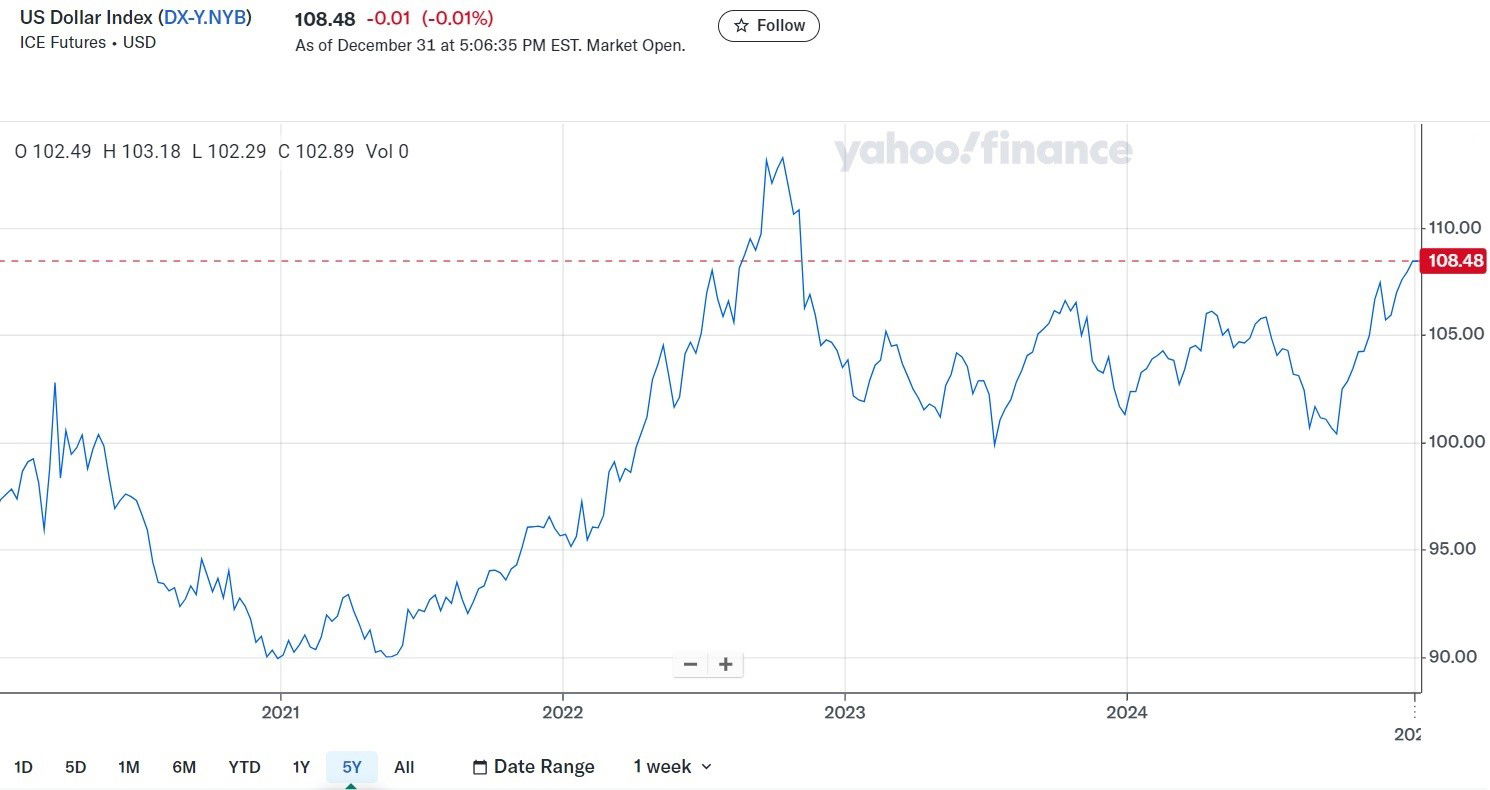

This chart shows the US Dollar Index rising to around 108.5 points, its highest level since November 2022. (In other words, this is the strongest its been in more than three years.)

In case you’re curious, this index tracks how the US dollar is performing against a basket of major currencies (including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc).

You may have noticed the USD rising sharply from September last year, if you look closely at the chart.

Around that time, betting odds were in favour of Donald Trump winning the US Presidential election (and he won by an bigger margin than expected).

Trump has promised to cut corporate tax, impose tariffs on goods imported from other nations (i.e. a trade war), loosen financial regulation, and clamp down on illegal immigration.

All up, Trump’s policies are likely to lift inflation (or prevent it from falling quickly), according to forecasts from well-regarded economists worldwide. It would also likely lead to the US government’s massive debt surging even higher.

Indeed, when the Fed held its mid-December policy meeting (and slashed interest rates again), the US central bank flagged there would be fewer rate cuts than it previously anticipated — because it expected inflation to be higher in 2025.

So that added further fuel to the US Dollar’s ascent!

How an investor sell-off is playing out in Victoria

A property investor sell-off is speeding up in Victoria, with the state’s rental stock falling at an increasingly rapid pace.

The number of active rental bonds (a proxy for the number of rental properties in a market) fell from 677,492 in September 2023 to 652,766 in 2024 — suggesting the state lost 24,726 rentals in the space of a year.

That equated to a 3.6 per cent fall in total Victorian rentals.

The pace of the sell-off also appeared to be increasing, with total rental bonds falling 4,315 in the three months to March 2024, by 7,820 in the three months to June, and 9,498 in the three months to September.

More in this story.

How the US greenback is impacting the AUD

You may be wondering: why the Australian dollar is so weak (and you’re getting a terrible exchange rate overseas).

The short answer is that the world’s most important currency (the US greenback) has been incredibly strong lately!

This chart shows the US Dollar Index rising to about 108.5 points, its highest level since November 2022.

ASX opens slightly higher on first day of trade for 2025

The benchmark index is currently up 0.1%.

We’ll bring you more soon.

How the Chinese currency is impacting the AUD

This from David Taylor’s piece yesterday:

“The problem with the Australian dollar appears to be that there was a real wobble in the Chinese currency into New Year’s Eve,” InTouch Capital Markets senior FX analyst Sean Callow said.

“Particularly the version of the Chinese currency traded outside mainland China.

“It fell sharply and broke a key level and that seems to have spilled over to [weakness in] the Aussie dollar.

“The Yuan is really finishing the year on a very weak note under a lot of pressure.”