World

Empire Newsletter: There’s a whole wide world outside of US ETFs

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Just like us

US-listed ETFs tend to get a lot of attention. And rightly so — nothing says “crypto is eating finance” more than Wall Street funds scooping up tokens for their shareholders.

But there’s a whole world outside of ETFs and even the US.

For sure, an overwhelming majority of assets under management (AUM) by crypto investment products are tied up in bitcoin and ether.

As the US waits for the SEC to formally approve the ether ETF registration statements (and for any decision on the solana ETFs) there are already a number of ETPs, ETNs and ETCs listed in the US and Europe backed by those cryptocurrencies.

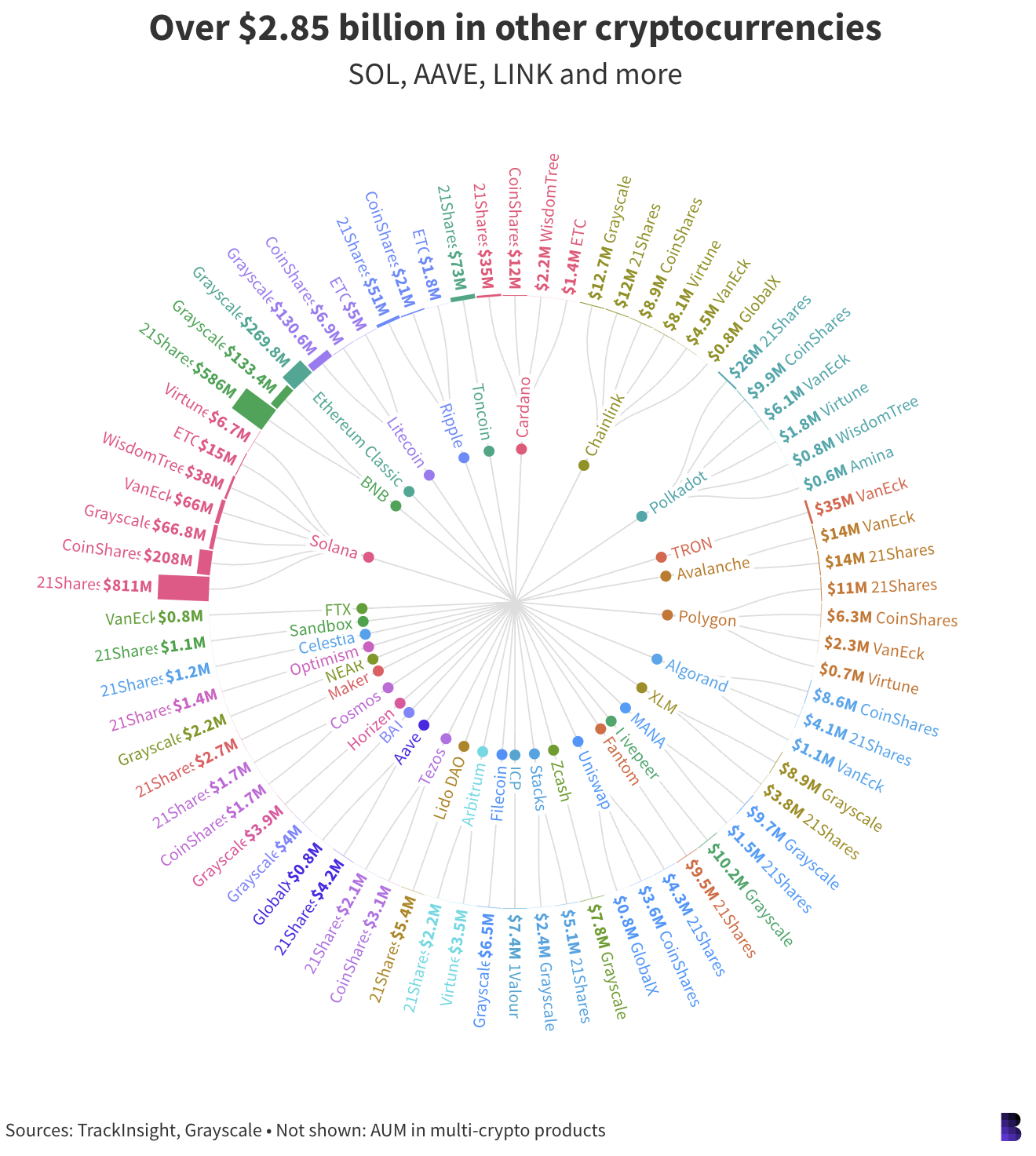

There are even more products with direct exposure to 33 additional tokens including celestia, optimism, fantom, uniswap and stacks.

Solana is so far the number-three pick from traditional finance types, with $1.22 billion split between funds from 21Shares, CoinShares, Grayscale, VanEck, WisdomTree, ETC and Virtune.

BNB, ethereum classic and litecoin are next in line, ranging from cumulative AUM of $719.4 million for the former and $142.5 million for the latter.

Buying all those cryptocurrencies is one thing, but it’s another to hold the right ones.

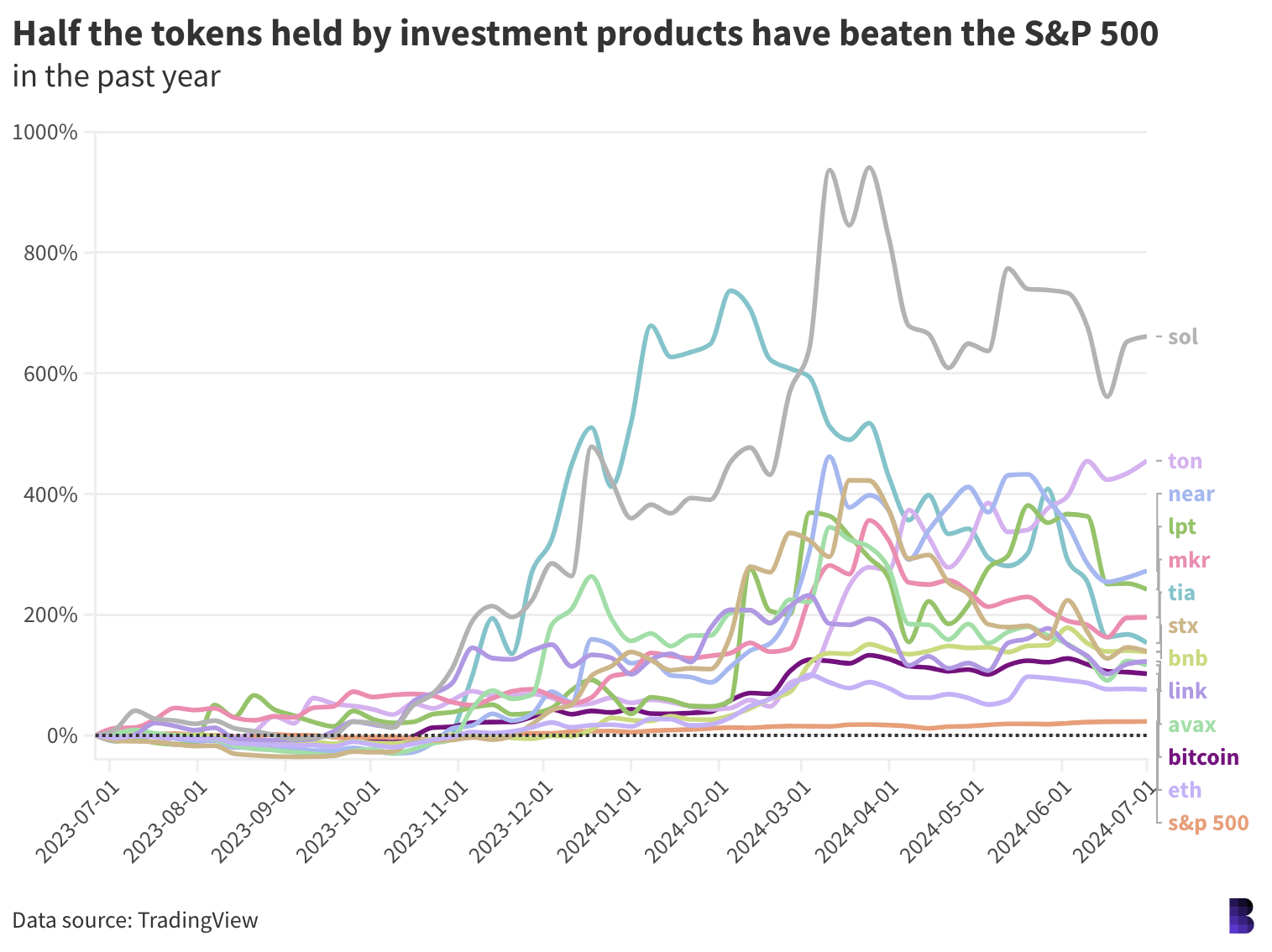

So far so good for most. Just over half of the tokens held by investment products have beaten the S&P 500 over the past year.

Solana, ton, near, livepeer, maker and celestia have led the pack, all posting more than 200% returns since this time last year as of earlier this week.

Bitcoin and ether were up 102% and 76% respectively.

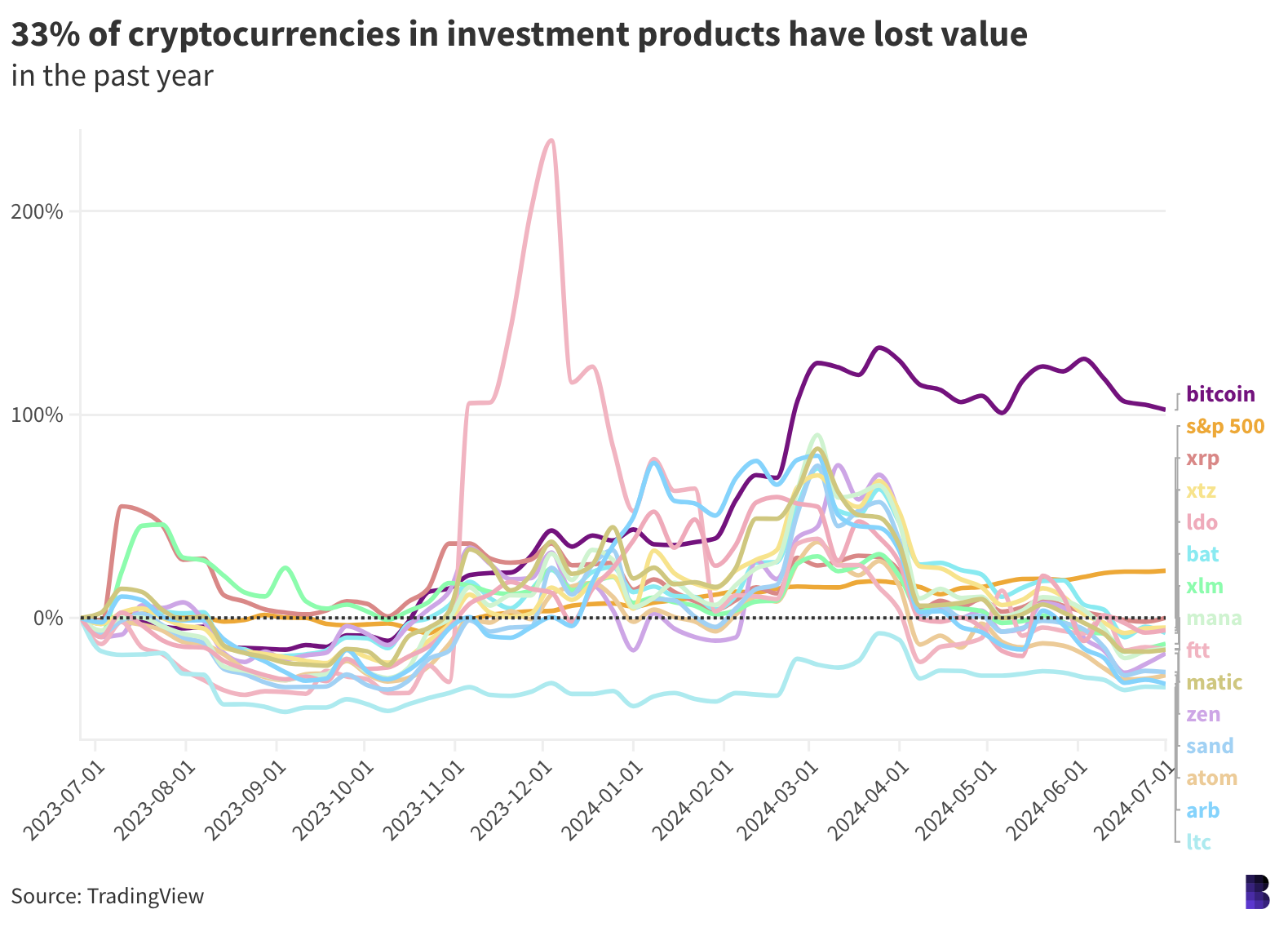

There are, however, some laggards. One-third of the cryptocurrencies held by the analyzed products are in the red this past year.

So, while it’s heartening to know that some percentage of token supplies might be gobbled up by traditional investment products — it can still go wrong for those buyers.

The products themselves can diverge from the underlying cryptocurrencies, especially with closed-ended funds like Grayscale’s, but the performance of the tokens alone shows the strike rate isn’t bad at all.

— David Canellis

P.S. Katherine and I need your help. Fill out this survey and help us produce journalism tailored to you and your interests.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.