Entertainment

Flutter Entertainment Stock: Leading U.S. Market With International Expertise (NYSE:FLUT)

ljubaphoto/E+ via Getty Images

Headquartered in Ireland, Flutter Entertainment plc (NYSE:FLUT) provides sports betting and gaming services to customers around the world. The company has a wide portfolio of brands, including the leading US brand FanDuel, as well as well-recognized brands in other parts of the world including BetFair, Sky Betting & Gaming, Paddypower, and Pokerstars among many other brands. In 2023, around 37% of revenues came from the rapidly growing US market, with the UK, Australia, and other European countries representing more mature operations.

After the stock started trading on the US market in late 2015, the stock has returned 60%, a reasonably low CAGR compared to the company’s incredibly high growth in the period as earnings have so far been lower due to extensive US growth investments.

FanDuel Carries Flutter’s Growth

Flutter’s most notable offering is FanDuel, as the brand leads the sportsbook segment by market share in the rapidly growing US market, also providing a leading iGaming platform – while Flutter also has US operations through TVG and PokerStars, FanDuel already represents the greatest revenue generator along with the best growth potential. Flutter’s current share of the brand is at 95% after the company bought a 37.2% stake from Fastball Holdings for $4.2 billion as announced in late 2020. The remaining 5% stake is still held by Boyd Gaming (BYD), better known for its brick-and-mortar casino holdings.

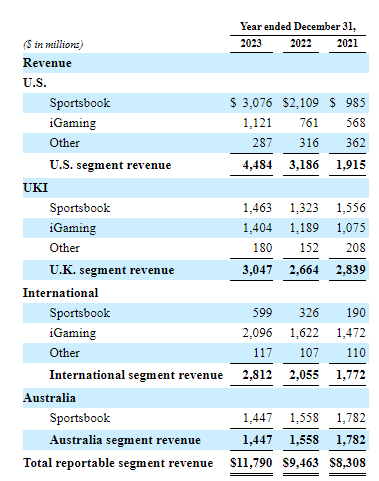

With the rapid growth of the US online gambling market, Flutter’s US revenues have increased from $1915 million in 2021 into $4391 million in 2023, still continuing the growth at 32% in Q1 combined with a 15% increase in average monthly players. Entries into new states and constantly growing customer wagering still provide a long runway for future growth for the brand – Statista estimates the US online sports betting market and online casino market both to grow at a 13.7% CAGR from 2023 to 2029.

I believe that FanDuel’s position in especially the sportsbook market is well solidified. The partnership with Churchill Downs (CHDN) making FanDuel the only place to bet on the 150th Kentucky Derby as a part of the companies’ multi-year agreement, and Boyd Gaming’s 16 FanDuel-branded brick-and-mortar sportsbooks further cement a leading brand position with presence in the more traditional casino market as well. Flutter’s established international expertise also provides valuable insights into expanding the business in the US.

Waiting For US Profitability to Scale

For the time being, FanDuel’s growth still comes with the caveat of lower profitability as competitors are trying to grab a share of the quickly legalizing market – while Flutter had a total 15.9% adjusted EBITDA margin in 2023, the US segment still only had a segment adjusted EBITDA margin of just 1.5%. Flutter’s total profitability has been pushed down from a 14.7% operating margin in 2018 into a low of -5.4% in 2021 and a currently slightly better trailing 2.6% level.

Extensive customer acquisition costs through bonuses and an extreme marketing spend worsen the market’s profitability for the time being, as competitors’ income statements also show. For example, DraftKings (DKNG) has reported a trailing -12.9% operating margin, being FanDuel’s most notable competitor in the US.

The weak profitability isn’t going to last forever. Both Flutter and DraftKings are already showing profitability improvements from aggressive operating leverage, as Flutter’s US market’s adjusted EBITDA has already risen constantly from -$711 million in 2021 into a finally positive level at $65 million in 2023. GAAP income and cash flows are going to be negative for a while, still, but the constant margin increases from growth are already encouraging.

Mature International Operations Provide Stable Cash Flows

International operations, still responsible for the majority of Flutter’s revenues, represent a better cash cow that Flutter is able to leverage to finance the US growth – the UK & Ireland, Australia, and International segments provided adjusted EBITDA of $488 million in Q1 alone, also being a more mature market requiring less investments into growth.

Flutter 2023 10-K Filing

Most of Flutter’s ex-US gambling markets are at a considerably different stage than the US – online gambling has been legal in many markets especially in Europe for a long time, with certain European markets now turning towards more regulated license models. For example, the German market turned into a license system in 2021 with the Dutch market following in the same path. Flutter’s large presence gives the company an ability to pursue licenses well, but ultimately, the countries’ potential further regulatory changes can potentially hinder Flutter’s operations. Flutter’s Australian operations through the Sportsbet brand have seen constant revenue declines, also being a more mature market for the company.

The UK market is still Flutter’s most notable ex-US market, and while new rules regarding consumer safety are coming into effect from H2/2024 to H1/2025 in the market, I believe that the country is a stable market for the company.

While regulatory changes pose a more notable threat to Flutter in territories outside the US, I don’t believe that Flutter’s international operations are likely to be affected too dramatically. The company continues to post growth in the more mature markets as well with an especially strong 20% growth in Q1 led by the UK & Ireland market.

Valuation: Flutter’s Performance Comes with a Price Tag

Flutter currently trades at a trailing EV/EBITDA of 26.2 and a P/B of 3.8 – on the surface level, the stock seems expensive. Still, with Flutter’s great prospects in the US, I believe that a good amount of growth should be priced in.

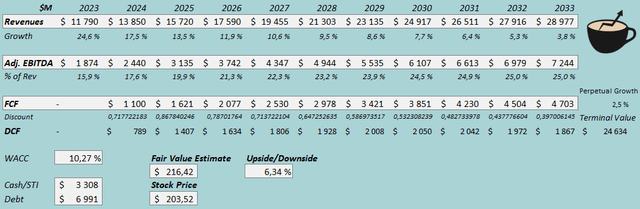

To estimate a fair value for the stock, I constructed a discounted cash flow [DCF] model.

With Flutter’s long growth runway ahead in the US, the company should grow revenues incredibly well in the foreseeable future with more stable international operations. After a 2024 revenue growth of 17.5%, in line with Flutter’s guidance, I estimate the growth to continue with a gradual slowdown into 2.5% perpetual growth from 2034 forward. From 2023 to 2033, the revenue estimates represent a CAGR of 9.4%.

As for the adjusted EBITDA margin, scaling US operations should aid expansion well with a guided 2024 expansion of 1.7 percentage points into 17.6% with the foreseen $2.44 billion. I estimate the margin to expand into an eventual level of 25.0% with growth, slightly lower than Flutter’s 25.6% ex-US segment adjusted EBITDA margin in 2023.

The company’s investments look to still push the cash flow conversion down with the adjusted EBITDA also being an overall optimistic earnings metric. Flutter should still have quite good cash flows going forward as US profitability improves and as more mature markets bring in constant healthy cash flows.

DCF Model (Author’s Calculation)

The estimates put Flutter’s fair value estimate at $216.42, slightly above the stock price at the time of writing – the company’s growth can’t be bought for cheap, but the stock still isn’t overvalued due to the great growth prospects.

CAPM

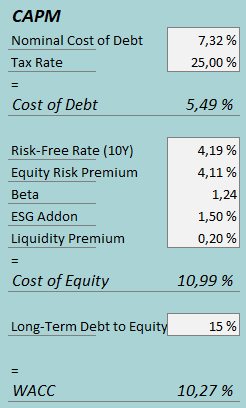

A weighted average cost of capital of 10.27% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Flutter had $128 million in interest expenses, making the company’s interest rate 7.32% with the current amount of interest-bearing debt. I estimate a moderate long-term debt-to-equity ratio of 15%.

To estimate the cost of equity, I use the 10-year bond yield of 4.19% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. While other markets represent the majority of current operations, I believe that the US’ likely growth into a dominant market makes the US’ equity risk premium the most relevant one. Yahoo Finance estimates Flutter’s beta at 1.24. With an ESG addon of 1.5% and a liquidity premium of 0.2%, the cost of equity stands at 10.99% and the WACC at 10.27%.

Takeaway

Flutter continues to grow in the rapidly expanding US gambling market, meanwhile the company’s international operations provide more stable cash flows to finance the investments into the growth market. Regulatory changes in ex-US markets pose more of a threat compared to the opportunity that regulatory changes have been in the US, but I believe that Flutter’s great presence in the markets brings an overall stable outlook internationally. Flutter’s expertise and great partnerships come with a price tag in terms of the stock’s valuation, but with the great US growth prospects, the stock still isn’t overvalued. As such, I initiate Flutter Entertainment at Hold.