World

US employment moderates along with wage growth; signals inflation slowdown

By Vince Golle and Craig Stirling

US employers probably tempered their hiring while wage growth moderated in June, another favourable development for Jerome Powell and his Federal Reserve colleagues seeking more confirmation that inflation is slowing.

Payrolls in the world’s largest economy are projected to have increased by about 190,000, according to a Bloomberg survey of economists ahead of Friday’s report. That’s a step down from the surprisingly robust 272,000 gain in May. The jobless rate probably held at 4 per cent.

The closely-watched jobs report will surface days after a Tuesday panel in Portugal that includes Fed Chair Powell. Investors will monitor his comments for clues on how soon the US central bank may start lowering interest rates. Christine Lagarde, Powell’s euro-area counterpart, will also be on the panel at the European Central Bank’s annual forum in Sintra.

While off the boil, the US labour market remains healthy, allowing consumer spending and the broader economy to continue plugging along despite higher borrowing costs.

Another key report for the coming holiday-shortened week in the US is expected to show a further decline in job openings, suggesting that companies are having greater success filing positions. Openings for May are projected to have dropped below 8 million for the first time since early 2021.

What Bloomberg Economics says…

“We’ve been expecting to see growing signs that monetary policy, with its long lags, was impacting the economy. The coming week’s data should provide more evidence.”

—Estelle Ou, Stuart Paul, Eliza Winger, Anna Wong and Chris G. Collins, economists.

In Canada, the labour force survey for June will provide insight into the job market, which has failed to keep pace with explosive population growth and yet has racked up higher-than-average wage gains. We’ll also get a look at the country’s international trade balance.

Elsewhere, the second half of 2024 will kick off with a packed week. Chinese business survey data and euro-zone inflation are among the highlights, and elections in France and the UK will also focus investors.

Asia

It’s a big week for purchasing manager indexes. China’s official PMIs due on Sunday are expected to show activity held steady in June, while the Caixin manufacturing PMI a day later may tick lower.

The other Caixin PMIs are published later in the week, along with PMIs for Indonesia, South Korea, Myanmar, Philippines, Malaysia Thailand, Taiwan, Vietnam and Singapore.

)

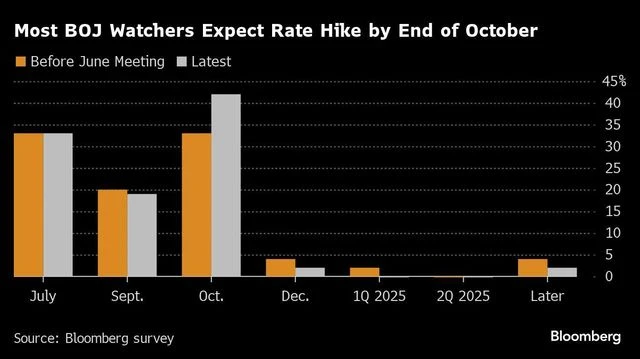

Later in the week, Japan’s household spending data may show outlays perking up in May, an outcome that would keep the BOJ on track for a rate hike as early as July.

Trade data are due in Australia and South Korea, while inflation reports are scheduled for South Korea, Indonesia, Pakistan, Thailand, Taiwan and the Philippines.

Among central banks, minutes from the Reserve Bank of Australia’s June meeting will draw a lot of attention on Tuesday after Governor Michele Bullock said the board considered a rate hike at that gathering.

Europe, Middle East, Africa

Politics will dominate the region, with crucial elections in the UK and France set to herald new governments and potentially shift the tone for economic policy in each country.

Britons go to the polls on Thursday, with voters poised to eject the ruling Conservatives after 14 years. The pressing question for the UK is how large of a majority Labour leader Keir Starmer will be able to command in Parliament.

In France, the first round of voting for the National Assembly takes place on Sunday, with run-offs a week later. Initial results on Monday indicating the level of support for Marine Le Pen’s far-right National Rally may prompt a market reaction.

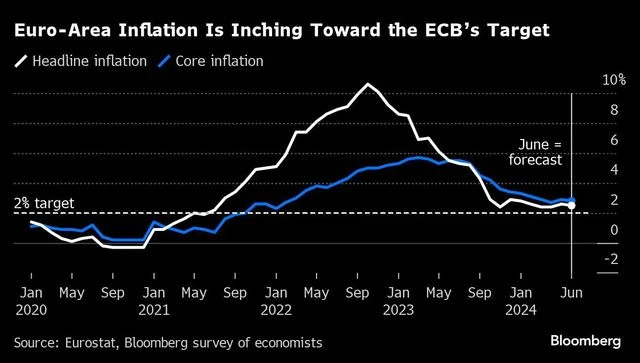

The aftermath of the first round may overshadow the ECB’s annual retreat in the Portuguese resort of Sintra, where officials will convene to discuss the economic issues. The event kicks off on Monday with a speech by Lagarde.

)

Also due from the ECB will be an account of its recent policy decision, due on Thursday, a day after Sweden’s Riksbank releases minutes of its own meeting from June 27.

Other national data within the euro region may focus investors. German and French industrial production on Friday, both for May, will indicate the strength of manufacturing midway during the second quarter in the region’s two biggest economies.

Switzerland will also release inflation data. That report on Thursday will show if consumer-price growth remains well below the central bank’s 2 per cent goal — a benign backdrop that allowed policymakers to cut rates earlier this month.

Turning east, a couple of monetary policy decisions are among the highlights. On Wednesday, Poland’s central bank is likely to keep borrowing costs steady as concerns over rapid wage growth outweigh worries about a patchy economic recovery.

And on Friday, Romania’s central bank may deliver a long-awaited rate cut after inflation — the highest in the European Union — slowed more than expected. The first reduction in more than three years would follow a surprise hold in June, when officials stayed cautious amid a ballooning budget deficit and growing wage demands.

Looking south, Turkish consumer-price growth on Wednesday is expected to finally slow after more than a year of aggressive rate hikes. Analysts forecast that inflation eased to 72.6 per cent from 75.5 per cent in May. The central bank is aiming to get that below 40 per cent by the end of the year, something most Turks and many foreign investors doubt can be achieved.

On Friday, South Africa’s Bureau for Economic Research will publish an inflation expectations survey for the second quarter. That will be closely watched by the central bank, which uses such two-years-ahead measures to inform its decision making. Officials said at the last policy meeting that they’re concerned inflation expectations are elevated.

Latin America

)

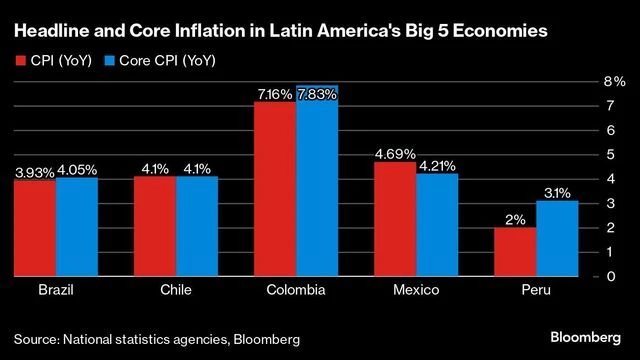

Economic activity and demand are on the rise in Chile, while the Lima consumer price report may underscore the persistence of core inflation that led the central bank to deliver a surprise interest rate pause on June 13.

In Colombia, the central bank on Thursday publishes the minutes of its June 28 policy meeting, at which BanRep’s board – led by Governor Leonardo Villar – lowered borrowing costs to 11.25 per cent with a fifth straight rate cut.

)

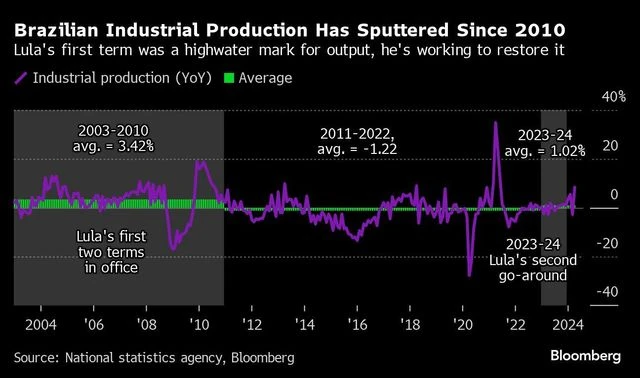

In Brazil, President Luiz Inacio Lula da Silva’s second stint as president has managed to pull industry out of a protracted funk, but the sector remains short of its former glory. May data will likely underscore the drag of tight financial conditions and subdued demand.

In a light week for Argentina, the highlight will be the central bank’s survey of local economists. While monthly inflation is back to single digits, the economists see the current pace of monthly readings as something of a floor in the short term.