Jobs

US Yields Sink as Jobs Fuel Bets on Jumbo Fed Cut: Markets Wrap

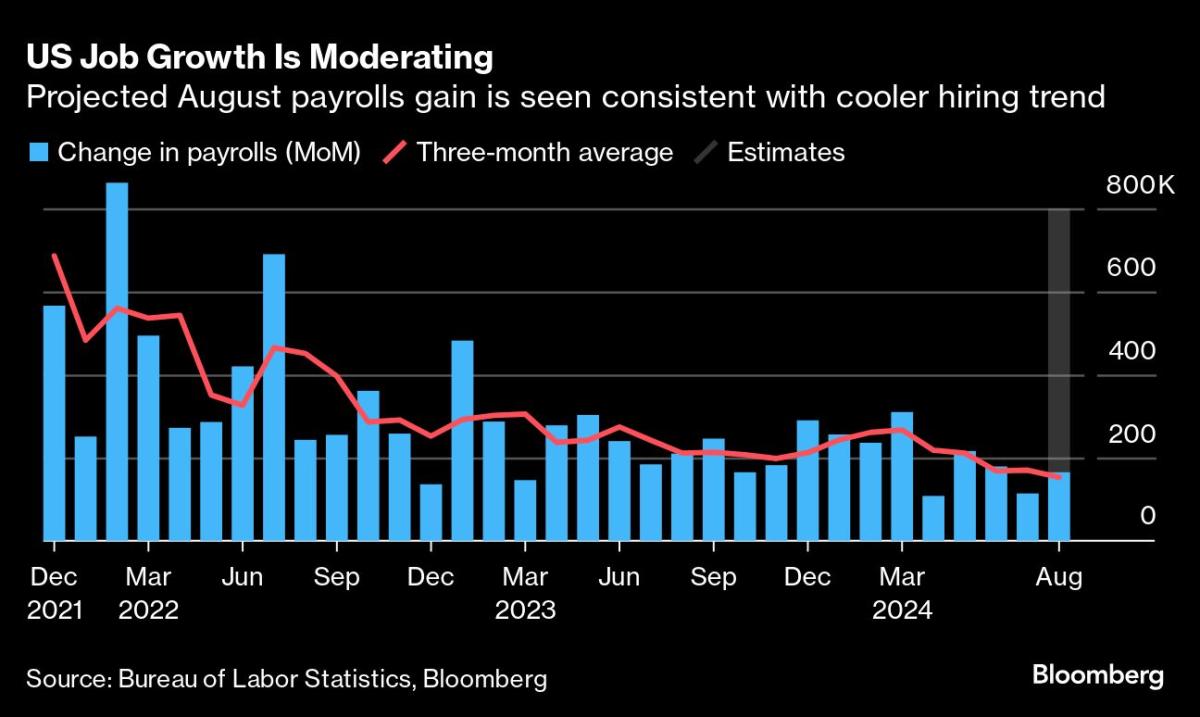

(Bloomberg) — Treasury yields tumbled after data showing a further slowdown in the US labor market boosted Wall Street’s bets on Federal Reserve rate cuts.

Most Read from Bloomberg

Just a few days ahead of the payrolls report, a reading on job openings trailed estimates and hit the lowest level since 2021. The figures sparked an immediate reaction in the bond market, pushing the US two-year note’s yield briefly below the 10-year note’s for only the second time since 2022 as traders built up wagers on a super-sized rate reduction this month.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

Fed’s Beige Book Shows Stagnant, Declining US Economic Activity

“The markets may not be as nervous as they were a month ago, but they’re still looking for confirmation the economy isn’t cooling off too much,” said Chris Larkin at E*Trade from Morgan Stanley. “So far this week, they haven’t gotten it.”

With the Fed set to begin cutting rates in a few weeks, the main question now is how big the first reduction will be. Monthly US employment data due Friday will probably determine the answer.

Investors are on the edge of their seats after the release of the jobs report last month stoked growth fears. Jerome Powell has made it clear the Fed is now more concerned about risks to the labor market than inflation, and another bad report would bolster the case for an outsize rate cut.

“Markets seem to see September as a coin flip between 25 and 50 basis points,” said Neil Dutta at Renaissance Macro Research. “I think going 25 bp risks the same market dynamic as skipping the July meeting. It’ll be fine until the next data point makes investors second guess the decision, fueling bets the Fed is behind the curve. Go 50 when you can, not when you must.”

Treasury 10-year yields declined six basis points to 3.77%. Swap traders have fully priced in a quarter-point rate cut in September — and a more than 30% chance of a half-point reduction. Over 100 basis points of easing is expected for the remaining three meetings this year.

The S&P 500 fell 0.4%. Nvidia Corp. extended losses. Verizon Communications Inc. is in advanced talks to acquire Frontier Communications Parent Inc., according to a person familiar with the negotiations. Joe Biden was said to be preparing to block Nippon Steel Corp.’s $14.1 billion takeover of United States Steel Corp.

To Krishna Guha at Evercore, the latest job-openings figures were “on the soft side,” but they do not suggest any rapid deterioration in the labor market.

“The still low level of layoffs and tick up in hires suggests the labor market is not cracking,” said Guha. “On net, we think JOLTS nudges down the bar for what the employment report Friday would need to deliver in order for the Fed to cut 50bp out the gates in September, though not radically.”

The stock market could be heading for correction if payrolls data comes in weak on Friday, according to Scott Rubner at Goldman Sachs Group Inc.

The bank’s clients are already positioning for a negative technical setup for share prices in the second half of September, Rubner wrote, adding that he expects a risk-off move to begin on Sept. 16. “A market correction may start to get traction if payrolls are weak,” he wrote.

Bank of America Corp. clients were net sellers of US equities for a second consecutive week, recording the biggest net sale of shares since late 2020 as uncertainty grows around the economic outlook.

Institutional, hedge fund, and retail clients all offloaded US stocks, with net sales totaling $8 billion in the week ended Aug. 30, quantitative strategists led by Jill Carey Hall said Wednesday in a note.

Bond traders are bracing for wilder market swings in the US than in Europe amid signs the world’s largest economy is faltering.

Kristina Hooper at Invesco expects the Fed will cut only 25 basis points, but anticipates that would only be the start of what is likely to be a “very significant easing cycle.”

Citigroup Inc. strategists see risk/reward attractive to position for a selloff in US rates via payer options, strategists including Jabaz Mathai and Jason Williams say in a note.

“Our general view on yields is that the market has more room to cheapen from here given that the most recent data are not suggestive of much weakening in activity, but we’ve been less inclined to sell outright.”

Corporate Highlights:

-

Uber Technologies Inc. is tapping the US investment-grade bond market for the first time since it attained blue-chip status.

-

Lyft Inc. plans to write down some of its bike and scooter rental assets, and cut 1% of its employees as the ride-hailing company struggles to turn consistently profitable.

-

Centene Corp. released a projection for members in its Medicaid program that disappointed investors.

-

The Nordstrom family is looking to take their namesake department store chain private in a proposed $3.8 billion deal.

-

Dollar Tree Inc. plunged in a harbinger of the pain coming for companies that cater to consumers earning less than $35,000 a year.

-

Dick’s Sporting Goods Inc.’s higher full-year forecast failed to match expectations for a more sizable upgrade — a repeat of Foot Locker Inc.’s experience last week.

Key events this week:

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.4% as of 2:59 p.m. New York time

-

The Nasdaq 100 fell 0.4%

-

The Dow Jones Industrial Average fell 0.2%

-

The MSCI World Index fell 0.6%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.3% to $1.1076

-

The British pound rose 0.2% to $1.3141

-

The Japanese yen rose 1.1% to 143.88 per dollar

Cryptocurrencies

-

Bitcoin fell 0.9% to $57,682.01

-

Ether fell 0.8% to $2,442.35

Bonds

-

The yield on 10-year Treasuries declined six basis points to 3.77%

-

Germany’s 10-year yield declined five basis points to 2.22%

-

Britain’s 10-year yield declined five basis points to 3.93%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Vildana Hajric.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.